CHAIN BRIDGE BANCORP (CBNA)·Q4 2025 Earnings Summary

Chain Bridge Bancorp Beats Q4 Estimates as Political Deposits Surge

January 28, 2026 · by Fintool AI Agent

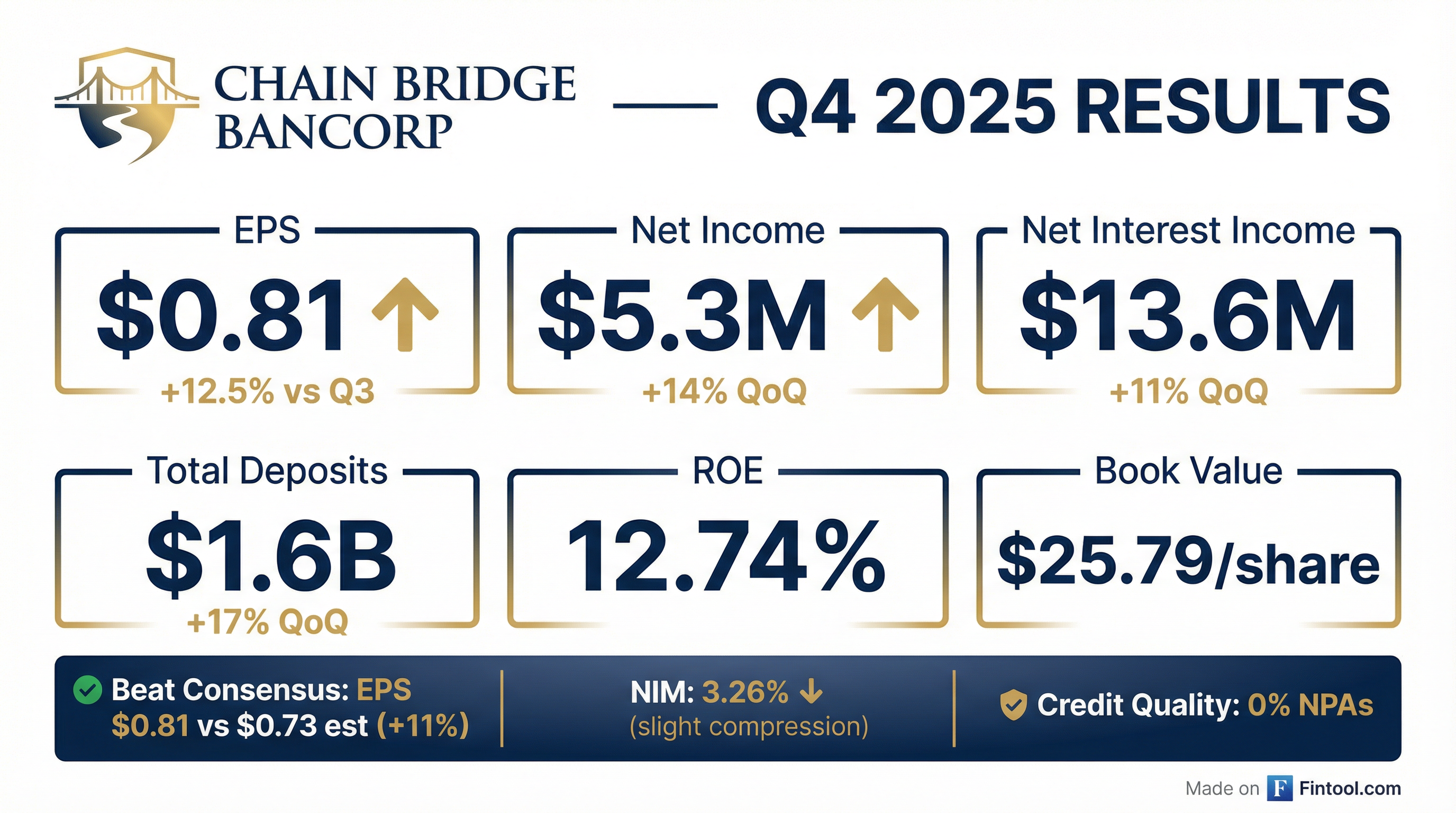

Chain Bridge Bancorp (NYSE: CBNA) delivered a strong Q4 2025, reporting EPS of $0.81 that beat consensus estimates by 11% . The McLean, Virginia-based bank saw deposits surge to $1.6 billion, up 17% quarter-over-quarter, driven by political organization inflows following the November 2024 federal elections .

Did Chain Bridge Bancorp Beat Earnings?

Yes. CBNA exceeded expectations across key metrics:

The beat was driven by a $1.3 million increase in net interest income from higher average interest-earning assets, despite a decline in the Federal Reserve's interest rate paid on reserve balances .

Compared to Q4 2024, net income rose 43% from $3.7 million to $5.3 million, reflecting the company's strong growth trajectory since its October 2024 IPO .

What's Driving the Deposit Surge?

Political organization deposits are CBNA's defining characteristic—and Q4 2025 showcased this unique business model. Key deposit metrics:

The company noted: "Our political depositors typically exhibit heightened activity during the quarters leading up to a federal election, contributing to the increase in balance sheet deposits and One-Way Sell deposits as of December 31, 2025 compared to September 30, 2025" .

The $213.5 million year-over-year increase in One-Way Sell deposits and $323.3 million increase in total consolidated deposits were partially attributed to political organization deposit inflows .

How Did Net Interest Margin Perform?

NIM compressed modestly but remains healthy:

The NIM decline reflects lower short-term interest rates—the yield on interest-bearing deposits at other banks fell from 4.43% in Q3 to 3.97% in Q4 . However, volume growth more than offset rate compression, pushing net interest income higher.

For full year 2025, net interest income reached $51.5 million, up 16% from $44.4 million in 2024 .

What About Credit Quality?

Pristine. CBNA reported:

- Non-performing assets to total assets: 0.00%

- Net charge-offs: 0.00%

- Allowance for credit losses on loans: 1.49% of gross loans

- Loan-to-deposit ratio: 17.46%

The extremely low loan-to-deposit ratio reflects CBNA's conservative balance sheet management—the bank holds the majority of deposits in interest-bearing reserves at the Federal Reserve ($580.9M) and investment securities ($865.3M) rather than loans ($274.8M) .

How Is Capital Position?

Well-capitalized with significant buffers:

Stockholders' equity grew $25.0 million during 2025 to $169.2 million, driven by net earnings of $20.2 million and a $4.7 million reduction in accumulated other comprehensive loss from improved securities valuations .

What's the Full Year Picture?

FY 2025 vs FY 2024 shows a nuanced story:

The EPS decline is primarily a math effect from the IPO—2024's EPS was calculated over fewer shares pre-IPO, while 2025 reflects the full diluted share count of 6.56 million shares .

The real story: deposit placement services income dropped $5.3 million YoY (from $6.2M to $838K) as the company retained more deposits on-balance-sheet as reciprocal ICS deposits post-IPO rather than placing them off-balance-sheet as One-Way Sell deposits .

Trust & Wealth Division Growth

A bright spot with AUA growing 85% YoY:

The increases reflect account growth, asset inflows, and market performance .

How Did the Stock React?

CBNA shares closed at $33.15 on January 28, 2026, down 0.8% on the day of the earnings release. The stock has performed well since its October 2024 IPO at ~$22, gaining approximately 50% in just over a year.

At current prices, CBNA trades at:

- 1.29x Book Value ($33.15 / $25.79)

- 10.8x TTM EPS ($33.15 / $3.08)

Key Risks to Watch

The company's risk factors center on deposit concentration :

- Political deposit cyclicality: Deposits typically surge before elections and decline after, creating balance sheet volatility

- Concentration risk: A small number of large political organization clients represent significant deposit balances

- Rate sensitivity: With $581M in Fed reserve balances, NIM is highly sensitive to Fed Funds rate changes

- Public company costs: The company cited increased expenses from its transition to public company status

The Bottom Line

Chain Bridge Bancorp delivered a solid Q4 beat driven by its unique political depositor franchise. The 11% EPS surprise and 17% QoQ deposit growth demonstrate the business model's strength, even as NIM compressed modestly from Fed rate cuts. With pristine credit quality, strong capital ratios, and a growing wealth management business, CBNA enters 2026 on solid footing—though investors should watch for typical post-election deposit normalization in the quarters ahead.

Data sourced from Chain Bridge Bancorp Q4 2025 8-K filing dated January 28, 2026 . Consensus estimates from S&P Global.